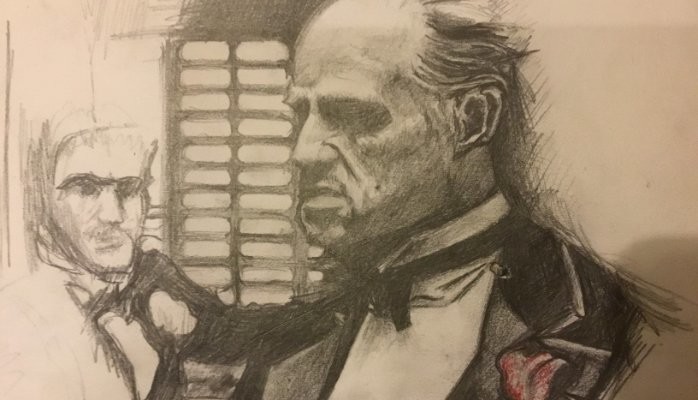

Consistently voted as one of the greatest movies of all time, The Godfather is a goldmine of business and leadership lessons. The movie highlights many of the biggest issues facing any family business, in particular the tension between “business” and “family” and even more acutely between the founder and the next generations.

Anyone running a family business knows what I’m talking about. It's never easy to transition even with the most benign family environments. Add a mix of sibling rivalry, a divorce or two and the scenes in Godfather are all too recognisable, actually they are mild compared to real life. It's the second and third generation of business ownership where things get particularly challenging, as this means there are more and more voices trying to make decisions - often with gut instinct rather than strategic rationale.

I work with several family business CEOs and last month I was lucky enough to hear the CEO of one of Australia’s most successful family business describe his story. What struck me was success was linked to a clear governance structure. Sustainability is all about transition from the founder to a more structured approach, which includes a need to be hard headed about the legacy business as the world gets smaller and more competitive.

The challenge, then, is to create a system of governance that preserves the various strengths associated with a family business while limiting many of their inherent weaknesses. To do that, we need to look at the path many family businesses take as they grow.

There isn't always a clear exit strategy

While true entrepreneurs from day one know that they're growing a business to sell it, not every business is formed with a clear exit strategy in sight. There is a minority of founders who set up a business with the sole purpose of passing it across the generations, most only work this through once the business is truly established.

There are plenty of examples of family businesses that have become bigger and bigger over the generations. The confectionary empire of Frank Mars is now into its second century, still 100% owned by the family. Cadbury went 150 years before it started to lose the family ties. Ford is still recognisable as the company Henry founded and the family is still involved, but at shareholder level. These are just the tip of the iceberg. In Australia where I now live there are many privately held but exceptionally strong family businesses that haven’t hit the headlines. But the issue of influence, of ownership and power is as acute here as anywhere.

It's this distinction between ownership and governance that's so important for family business owners to be aware of, as it allows them to find more effective ways of balancing power between multiple stakeholders. Peter Crow, who specialises in Family Business Governance, said that a family business needs to use a proper board structure when the owners can’t all fit round the kitchen table. I think that is a really useful image.

"A family business needs to use a proper board structure when the owners can’t all fit round the kitchen table"

When does a business need a Board?

Once the ownership gets that size, then by definition not all can have an equal voice. Without proper governance, Uncle Ned will feel he has been undermined, Auntie Florence still wants to invest in her pet project, Cousin Jack wants some money to invest in his own business. And Dad, who is now 85, still sits at the head of the table and thinks that what got the business to where it is today will keep it there.

Strong Governance is now essential; emotions are likely to get more intense otherwise. In many ways the issues are exactly the same as those faced by Publicly Listed Companies – investors need to be informed, but be kept out of micro management and they need to entrust their wealth to others, who manage the business in the interests of all stakeholders.

What Governance is, and what it isn’t.

Governance acts as a necessary antidote to the emotions and gut-feelings that so often dictate decisions in a family-business environment. Adrian Cadbury's definition puts this into perspective, defining governance as "The system by which companies are directed and controlled".

"System" is the key word in that definition, as the very mention of the word separates it completely from anything that could be inspired by gut instinct or emotion. Instead there are processes in place that channel the potentially disparate whims of family shareholders into actionable decisions through the professional CEO supported by some independent minded Directors.

There's a common misconception that governance is compliance. Peter Crow emphasises forward looking business strategy as the priority; compliance is purely a rear view mirror exercise. With most businesses expected to be disrupted significantly within the next 5 years it is almost criminal not to have both strong governance and a forward looking strategic stance. This in my view should be led by the CEO but with an Independent Chair managing the Governance process, supporting the CEO and managing the interface between the business and the family.

Who has the Courage to make the change?

Family businesses often have a unique set of inherent values which have significant effects on the way the business grows and how the topic of succession is discussed. They can be patient and benefit from the virtues of patience in that they tend to have stronger balance sheets and are less dependent on debt. This also means they can take quite exceptional risks in new ventures.

However, there is always a risk that later generation family members develop a sense of entitlement, an attitude of inherited wealth and an expectation of a job to fit their lifestyle.

At some point a second generation leader has to step forward and implement the transition as a professional CEO.

The courage this requires is exceptional. The founder may acknowledge the need for succession, but rarely without some misgivings. The extended family anticipate, correctly, the loss of their direct control. The leadership role here is a massive communication effort to the extended family to promote the inevitability of the transition and the underlying principles of fairness, accountability and creating value.

Key Elements for a Sustainable Family Business

Governance Structure

Separate the extended family from running the business by having a Council – with broad representation from the current generation and a Board, with both family and independent representation and an independent chair.

Leadership and Succession

Choose the best people to run the business whether family or not. Family members who wish to pursue a career in the business get help in training and development to give them the best chance, but no automatic entitlement.No family member should expect a job as a birthright or entering the business in a management role.

Values

Enshrine the original founder’s values with the purpose of sustainability, but do not get stuck in heritage. These include the respect for the Board’s authority in running the business and the Council’s authority in dealing with family distribution issues etc.

Strategy

Focus on creating family wealth and sustainability. A rational and value driven approach to business opportunity with a long term investor mentality; many times this requires some portfolio thinking and diversification from the core business and sometimes this means the original businesses are eventually passed to others.

Those CEOs who have succeeded in this transition usually recognised early on that they cannot do this alone. Advice from outside the family and strong emotional support from peers and mentors is at the heart. Expect the journey to be rocky at stages and keep an eye on the longer term prize. In Australia support is available from TEC groups and from Family Business Australia

I'd be interested to hear of others' experiences and journeys and if you have other suggestions to the basic elements I've outlined here.

Image Credit: An original illustration by Hamish Lindsay.